Budget 2026: A Guide to What’s New and Unchanged in Your Income Tax

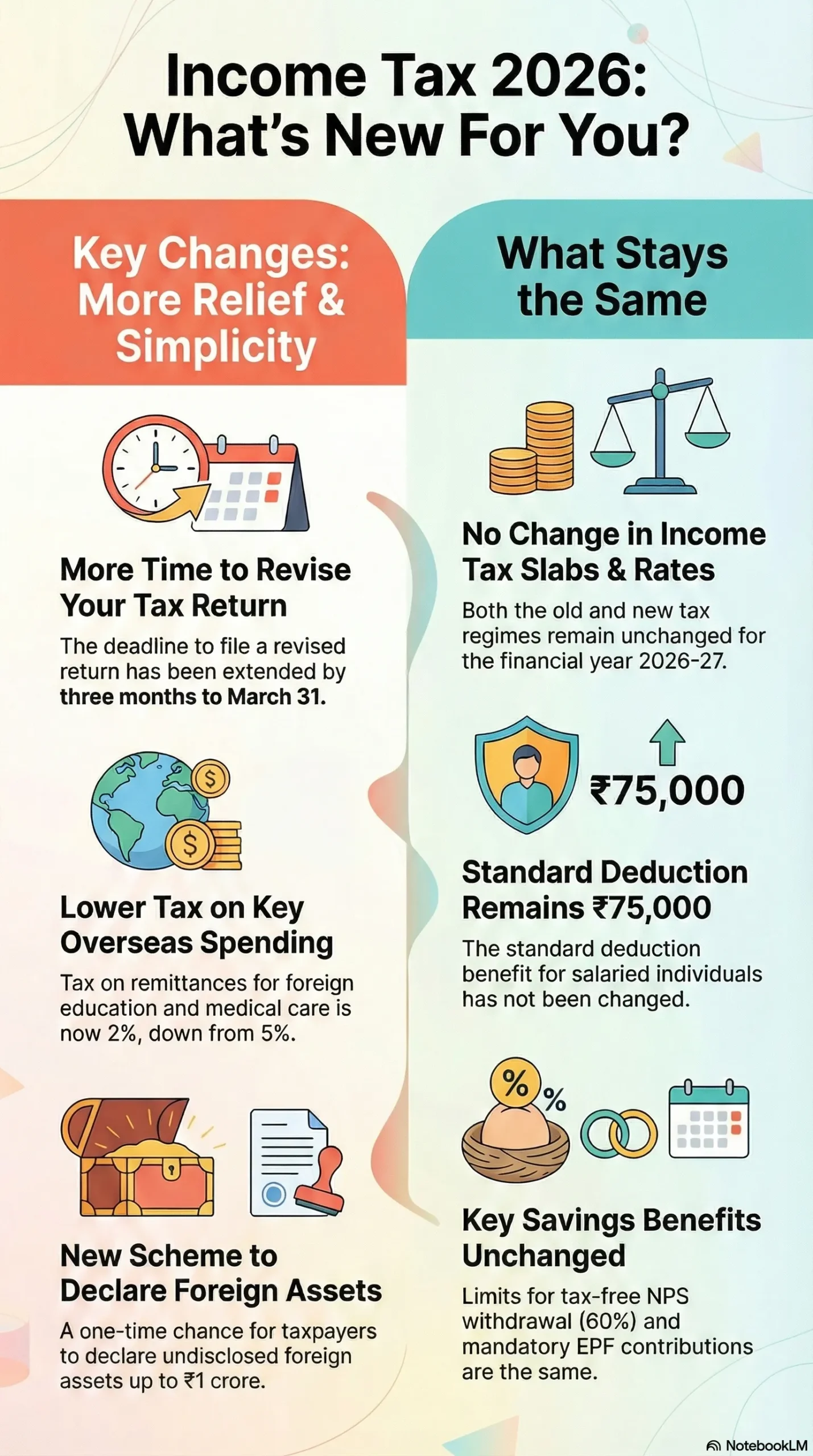

Forget about new tax slabs or rates this year. The Union Budget 2026-27 focuses squarely on simplifying procedures, easing compliance, and offering targeted relief for specific expenses like overseas education and medical care. While the headline-grabbing tax cuts were absent, several key changes aim to make your financial life slightly easier.

Here’s a quick look at the immediate takeaways:

- 📅 More Time to Fix Returns: The deadline to revise a filed Income Tax Return (ITR) has been extended by three months to March 31.

- 💰 Lower Cost for Key Expenses: The Tax Collected at Source (TCS) rate on foreign remittances for overseas education and medical treatment is now 2%, down from 5%.

- 🔓 A Chance to Declare Foreign Assets: A new one-time disclosure scheme allows small taxpayers with undisclosed foreign income/assets (up to ₹1 crore) to come clean at a defined tax rate.

- 🧾 Simplified Filing for Some: Small taxpayers can now obtain a “nil deduction” certificate to avoid TDS, and the system for automated tax filing for eligible senior citizens continues.

What Has Not Changed for Taxpayers

First, it’s crucial to understand what remains the same, as many anticipated changes did not materialize.

No Change in Tax Slabs and Rates

The budget did not introduce any changes to the income tax slab rates for either the old or the new tax regime for the financial year 2026-27.

Key Benefits Unchanged

- Standard Deduction: Remains at ₹75,000.

- NPS Withdrawal: The tax-free lump sum withdrawal limit stays at 60%.

- EPF Contribution: The ₹15,000 monthly wage ceiling for mandatory contributions remains unchanged.

Key Changes: Relief and Simplification

The government has introduced several procedural relaxations and specific reliefs.

1. Extended ITR Revision Window

- The Change: You now have until March 31 of the relevant financial year to file a revised return, instead of the previous December 31 deadline.

- Impact: This provides an extra three months to correct mistakes or include missed information in your originally filed return.

2. Reduced TCS on Overseas Spending

- The Change: The TCS rate under the Liberalised Remittance Scheme (LRS) has been reduced for two critical areas:

- Education & Medical Treatment: Rate reduced from 5% to 2%.

- Overseas Tour Packages: Rate has also been substantially lowered.

- Impact: Directly lowers the immediate cash outflow for families managing education abroad or specialized medical care overseas.

3. New Disclosure Scheme for Small Taxpayers

- The Change: A one-time scheme allows individuals with undisclosed foreign income or assets (up to ₹1 crore) to declare them by paying tax at 30% on the fair market value.

- Impact: Provides a compliant exit route for students, professionals, or NRIs who may have inadvertently failed to disclose such assets, helping them avoid harsher penalties.

4. Other Notable Updates

- Tax-Free Accident Compensation: Interest awarded by Motor Accident Claims Tribunals to individuals is now fully exempt from tax.

- “Nil Deduction” Certificate: Taxpayers whose income is below the taxable limit can obtain this certificate to prevent TDS deductions, improving cash flow.

The Bigger Picture: The New Income Tax Act Looms

An important backdrop is the upcoming Income Tax Act, 2025, set to replace the 1961 law from April 1, 2026. The procedural tweaks in this budget may be stepping stones toward the more comprehensive simplification promised by the new Act.

How to Plan for FY 2026-27

- Mark the New Deadline: Note the March 31 deadline for revising your ITR for the last financial year.

- Assess Foreign Assets: If applicable, evaluate the new disclosure scheme with a tax advisor.

- Use the Nil Certificate: If eligible, apply for the “nil deduction” certificate to stop unnecessary TDS.

While Budget 2026 didn’t rewrite the tax rulebook, it made meaningful strides in reducing friction for taxpayers. The focus on easing compliance and providing targeted relief, especially for families with international financial commitments, is a clear theme. The promise of a simpler system lies ahead with the new Income Tax Act, but for now, these changes offer pragmatic, incremental ease.