India’s New 2026 Baggage Rules – Higher Limits, Easier Customs

The government has introduced a complete overhaul of the customs baggage rules, which came into effect on February 1, 2026. Whether you’re a resident Indian returning from abroad, an NRI visiting home, or a foreign tourist, the new Baggage Rules, 2026 will directly impact what you can bring in, how much duty you pay, and how you clear customs.

GConnect breaks down the key changes you need to know for a hassle-free travel experience.

🆕 What’s New & Different?

The rules replace the 2016 regime and aim to simplify procedures, increase transparency, and use more digital processes. The most notable shifts are higher duty-free limits, weight-based jewellery allowances, and provisions for temporary import of valuables.

📊 Key Changes at a Glance

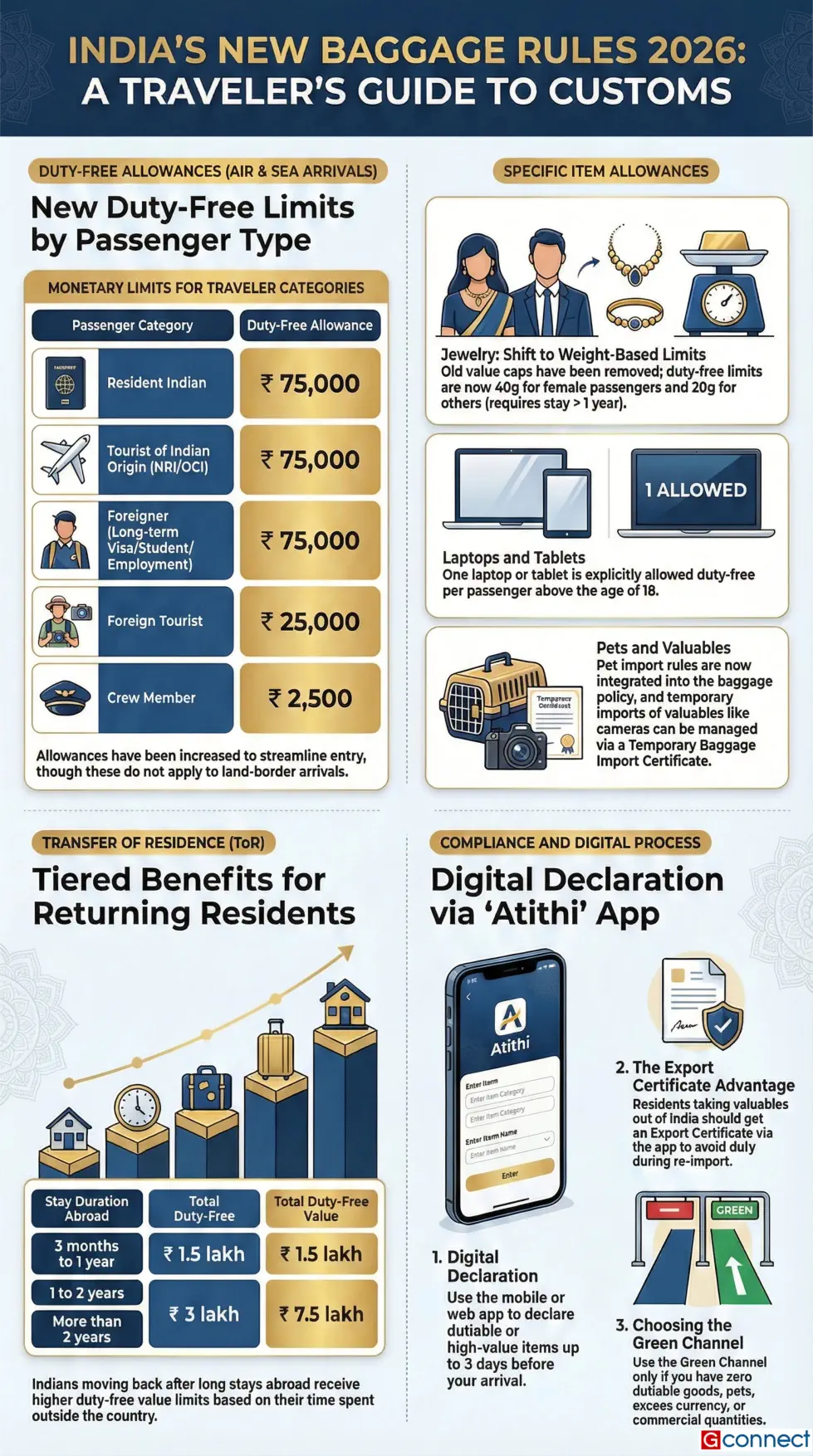

1. Duty-Free Allowances (For Air/Sea Arrivals)

You can now bring in more goods without paying customs duty.

| Who are you? | Duty-Free Allowance |

|---|---|

| Resident Indian | ₹ 75,000 |

| Tourist of Indian Origin (NRI/OCI) | ₹ 75,000 |

| Foreigner with a long-term visa (e.g., employment, student) | ₹ 75,000 |

| Foreign Tourist | ₹ 25,000 |

| Crew Member | ₹ 2,500 |

⚠️ Important: If you are entering India by land, these allowances do not apply. Only used personal items for daily needs are allowed duty-free.

2. Jewellery Allowance (Weight-Based)

If you are an Indian resident or of Indian origin returning after staying abroad for over 1 year, you can bring jewellery duty-free by weight:

- Female passengers: Up to 40 grams

- Others: Up to 20 grams

(Old value caps have been removed)

3. Transfer of Residence (ToR) Benefits Simplified

For Indians moving back after a long stay abroad, the benefits are now clearer and more valuable:

| Stay Abroad | Total Duty-Free Value |

|---|---|

| 3 months to 1 year | ₹ 1.5 lakh |

| 1 to 2 years | ₹ 3 lakh |

| More than 2 years | ₹ 7.5 lakh |

4. Temporary Import Made Easier

- Tourists can bring valuables (e.g., cameras, jewellery) for temporary use by declaring them and obtaining a Temporary Baggage Import Certificate. The items must be re-exported when leaving.

- Residents taking valuables out of India can get an Export Certificate via the ‘Atithi’ app to show during re-import, avoiding duty.

5. Clear Inclusion of Laptops & Pets

- One laptop/tablet per passenger above 18 years is now explicitly allowed duty-free.

- Rules for importing pets are clearly part of the baggage policy.

🛃 Process & Compliance: What You Must Do

- Digital Declaration is Key: Use the new ‘Atithi’ web or mobile app to declare any dutiable, restricted, or high-value items. You can do this up to 3 days before arrival.

- Green Channel: Only if you have nothing to declare (no dutiable goods, no excess currency, no pets). If unsure, declare.

- No Commercial Goods: Do not bring goods in commercial quantities as baggage. This can lead to heavy fines, confiscation, and legal action.

- Unaccompanied Baggage: Rules are clearly defined. Your declaration for accompanied and unaccompanied baggage will be linked to prevent misuse of allowances.

💡 The Bottom Line for Government Employees & Travelers

The new rules represent a more trusting, passenger-friendly approach by Indian Customs. The focus is on rewarding genuine travelers with higher limits while using technology and risk-based checks to streamline clearance.

Before your next international trip:

- Check your eligibility based on passenger category.

- Use the ‘Atithi’ app for advance declaration if carrying valuables.

- Keep proofs of purchase for high-value items.

- If returning after a long stint abroad, explore the Transfer of Residence benefits.

Official Resources: