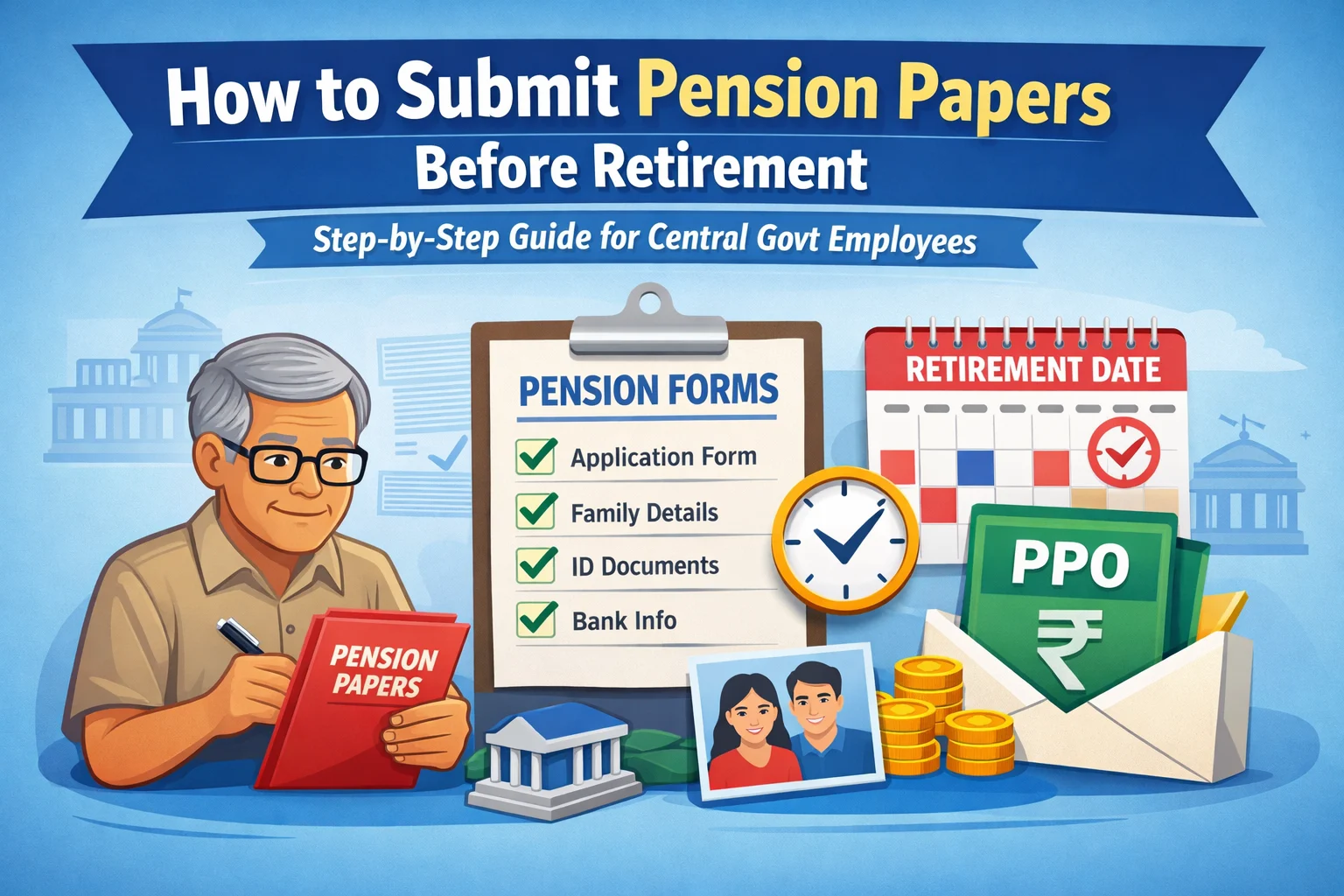

How to Submit Pension Papers Before Retirement

Retirement is a major milestone, and timely submission of pension papers ensures that your pension starts without delay. Many retirees face unnecessary stress simply because forms were submitted late or with missing details.

This guide explains when, how, and what you need to submit your pension papers before retirement—without jargon and without confusion.

When Should Pension Papers Be Submitted?

The process officially begins two years before your date of retirement.

- 24 months before retirement: Your Head of Office starts verifying your service records

- 12 months before retirement: You are required to submit pension forms

- On retirement: Pension payment should ideally start from the next month

👉 Starting early helps avoid last-minute corrections that can delay pension authorization.

Step 1: Verification of Service Records (2 Years Before Retirement)

About two years before retirement, your office will:

- Verify your qualifying service

- Check entries related to appointments, promotions, leave, and suspension, if any

- Identify gaps or missing records

What you should do

- Cooperate with the office during verification

- Provide copies of appointment orders or promotion orders if asked

- Ensure your date of birth and date of appointment are correct

This step is crucial—errors here directly affect pension calculation.

Step 2: Submit Pension Application (1 Year Before Retirement)

One year before retirement, you must submit your pension papers in the prescribed forms.

Commonly required forms include:

- Pension application form

- Details of family members

- Nomination for gratuity

- Bank account details for pension credit

- Commutation of pension option (if applicable)

Your office will guide you on the exact form numbers applicable to your case.

Step 3: Documents to Be Attached

Along with the forms, keep these documents ready:

- Recent passport-size photographs

- Specimen signatures or thumb impressions

- Copy of Aadhaar / PAN (as required)

- Joint photograph with spouse (in many cases)

- Bank passbook copy or cancelled cheque

👉 Make sure names, spellings, and dates match across all documents.

Step 4: Verification by Head of Office

After submission:

- The Head of Office checks all forms and documents

- Pension, gratuity, and commutation amounts are calculated

- A formal pension proposal is prepared and forwarded to the pension sanctioning authority

If any discrepancy is found, you may be asked to resubmit corrected forms—so keep copies handy.

Step 5: Issue of Pension Payment Order (PPO)

Once approved:

- Your Pension Payment Order (PPO) is generated

- PPO details are sent to the bank or pension disbursing authority

- Pension usually starts from the month following retirement

You will also receive a copy of the PPO number for future reference.

Common Mistakes That Delay Pension

Avoid these frequent issues:

- Submitting forms late

- Incomplete family or nomination details

- Mismatch in name, date of birth, or bank details

- Not responding promptly to office queries

A little attention here can save months of delay later.

Important Tips for a Smooth Pension Process

- Start preparing documents at least 18 months in advance

- Keep multiple photocopies of all submitted forms

- Ensure your bank account is active and KYC-compliant

- Track your case status through your office until PPO is issued

Final Words

Submitting pension papers before retirement is not complicated—but it does require timing, accuracy, and follow-up. If you begin early and respond promptly to your office, your pension should start smoothly without disruption.