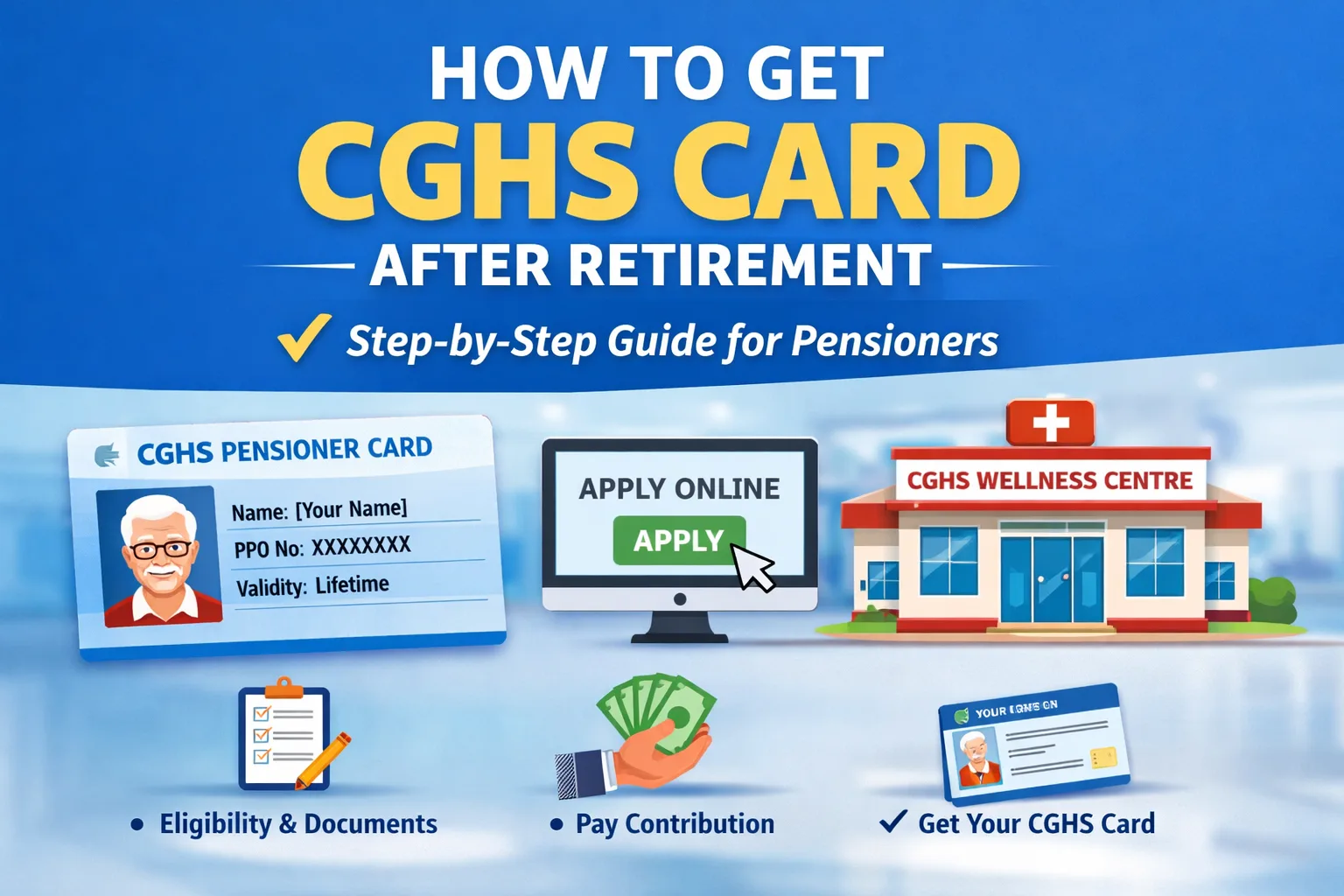

How to Get CGHS Card After Retirement: Step-by-Step Guide

Retirement marks the end of service, but it does not mean losing access to government healthcare. If you were covered under CGHS during service, you are eligible to continue CGHS benefits after retirement by obtaining a Pensioner CGHS Card.

This guide explains who is eligible, what documents are required, and how to apply online or offline without confusion.

Who Is Eligible for CGHS After Retirement?

You can apply for a CGHS card after retirement if you are:

- A Central Government pensioner

- A family pensioner (spouse of a deceased CGHS-covered employee)

- A retired employee of an autonomous body covered under CGHS (where applicable)

📌 The basic condition: CGHS contribution must be paid after retirement.

Types of CGHS Cards for Pensioners

After retirement, CGHS cards are issued as Plastic Smart Cards. They cover:

- The pensioner

- Spouse

- Dependent parents

- Dependent children (as per CGHS dependency rules)

Contribution Amount for CGHS After Retirement

Pensioners must pay CGHS contribution based on their last basic pay (or pension category).

You have two options:

1. Annual Contribution

Paid yearly, category-wise (Level 1 to Level 12 & above)

2. Lifetime Contribution (One-Time Payment)

- Covers CGHS for entire lifetime

- Strongly recommended to avoid yearly renewals

💡 Most retirees prefer the lifetime option for peace of mind.

Documents Required

Keep these ready before applying:

- PPO (Pension Payment Order) or provisional PPO

- Last Pay Certificate (or pension details)

- Aadhaar card

- PAN card

- Passport-size photograph

- Proof of residence

- Details of dependents (DOB, Aadhaar, income declaration)

- Mobile number & email ID

How to Apply for CGHS Card After Retirement (Online)

Follow these steps carefully:

Step 1: Visit the CGHS Portal

Go to the official Central Government Health Scheme website.

Step 2: Choose Pensioner Category

Select “Apply for CGHS Card – Pensioner”.

Step 3: Fill the Application Form

Enter:

- PPO details

- Pension sanctioning authority

- Personal and dependent details

Step 4: Upload Documents

Upload scanned copies of all required documents.

Step 5: Pay CGHS Contribution

- Choose Annual or Lifetime option

- Pay online via net banking / UPI / card

Step 6: Submit Application

After submission, acknowledgement slip is generated.

How to Apply Offline (If You Prefer Physical Mode)

- Visit your nearest CGHS Wellness Centre

- Collect Pensioner CGHS Application Form

- Attach photocopies of documents

- Pay contribution at the designated counter / bank

- Submit the form and collect acknowledgement

📌 Offline processing may take slightly longer than online mode.

What Happens After Submission?

- Application is verified by CGHS authorities

- Contribution payment is confirmed

- Plastic CGHS card is printed

- SMS/email notification is sent

⏱️ Normal processing time: 7–15 working days

How to Download CGHS Card Online

Once approved:

- Log in to the CGHS portal

- Download temporary CGHS card (PDF)

- Use it immediately until plastic card is issued

The physical card can be collected from the wellness centre or received by post (city-dependent).

Important Tips for Retiring Employees

- Apply for CGHS immediately after retirement to avoid coverage gaps

- Opt for lifetime contribution if financially feasible

- Ensure dependents’ details are accurate to avoid rejection

- Keep a digital copy of PPO and CGHS card safely stored

Frequently Asked Questions

Can I apply for CGHS after retirement if I was not a CGHS beneficiary during service?

No. CGHS after retirement is allowed only if you were covered during service.

Is CGHS mandatory after retirement?

No, it is optional—but highly beneficial due to low cost and wide hospital coverage.

Can CGHS city be different from last place of posting?

Yes. You can choose any CGHS-covered city where you settle after retirement.

Final Word

Getting a CGHS card after retirement is a one-time process that ensures continued access to affordable healthcare for you and your family. Whether you choose online or offline mode, applying early and opting for lifetime contribution can save future hassles.