Simplifying Tax Disputes with the DTVSV Scheme 2024: Key Benefits and Insights

The Central Board of Direct Taxes (CBDT) has formally introduced the Direct Tax Vivad Se Vishwas Scheme, 2024 (DTVSV), which will come into effect on October 1, 2024. This scheme, aimed at resolving pending income tax disputes, was first announced in the Union Budget 2024-25 by Finance Minister Nirmala Sitharaman, according to an official press release from the Ministry of Finance.

Introduction to DTVSV Scheme, 2024

The Direct Tax Vivad se Vishwas Scheme (DTVSV), 2024 is an initiative by the Indian government to resolve pending tax disputes and reduce litigation. Following the success of the previous Vivad se Vishwas scheme in 2020, this new iteration seeks to provide an even more efficient platform for taxpayers to settle disputes amicably. With thousands of cases locked in various stages of litigation, the scheme aims to offer a simple, transparent, and swift process for settling direct tax disputes, benefiting both taxpayers and the government.

In a country where tax disputes can linger for years, the DTVSV 2024 brings hope for a cleaner, less contentious tax environment. The scheme offers significant incentives, including waivers of penalties and interest, to encourage taxpayers to resolve their disputes without prolonged litigation. It represents the government’s continued efforts to build trust with taxpayers and streamline the tax collection process.

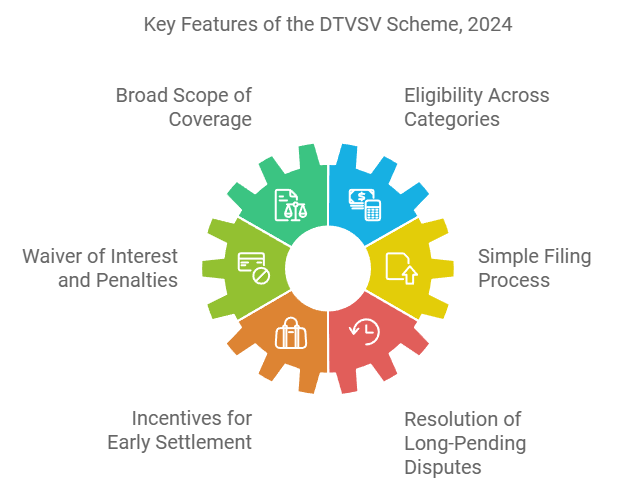

Key Features of the DTVSV Scheme, 2024

The DTVSV Scheme, 2024 has been designed with several taxpayer-friendly features aimed at reducing litigation and simplifying tax dispute resolution. Here are some of the key features:

- Broad Scope of Disputes Covered

The scheme applies to a wide range of tax disputes, including those related to income tax, wealth tax, securities transaction tax (STT), and more. It covers disputes that are pending in appellate forums, such as the Income Tax Appellate Tribunal (ITAT), the High Courts, and the Supreme Court, as of the cutoff date specified. - Eligibility Across Categories

The scheme is open to all categories of taxpayers—individuals, Hindu Undivided Families (HUFs), firms, and companies—ensuring that any entity involved in a tax dispute is eligible to apply. - Waiver of Interest and Penalties

One of the most attractive features is the waiver of interest and penalties. Taxpayers opting for the scheme are only required to pay the disputed tax amount, without additional burdens such as interest or penalties, provided they comply within the specified timeframes. - Simple, Transparent Filing Process

The DTVSV Scheme, 2024 offers a streamlined online filing process. Taxpayers can submit their application, dispute details, and payment online, eliminating the need for lengthy court procedures and reducing the overall time required to settle disputes. - Incentives for Early Settlement

The scheme encourages early resolution by offering additional incentives to taxpayers who settle disputes before the deadline. This includes further reductions in payable amounts, making it even more appealing to resolve disputes quickly. - Resolution of Long-Pending Disputes

The scheme is specifically designed to tackle disputes that have been pending for a long time, ensuring faster clearance of cases. Taxpayers with cases spanning multiple years can benefit from the one-time settlement opportunity.

Eligibility Criteria

The DTVSV Scheme, 2024 provides a platform for a wide range of taxpayers and disputes, but there are specific criteria for eligibility. Understanding who qualifies is crucial for taxpayers looking to take advantage of this scheme. Below are the key points outlining eligibility:

- Eligible Taxpayers

The scheme is open to all categories of taxpayers, including individuals, Hindu Undivided Families (HUFs), companies, partnerships, trusts, and other legal entities. This inclusivity ensures that any taxpayer involved in a direct tax dispute can benefit from the scheme. - Disputes Covered

The scheme covers all disputes related to direct taxes such as income tax, wealth tax, and related surcharges. Any case that is under appeal, pending in court, or in arbitration as of the specified cutoff date qualifies for the scheme. It also includes cases pending before the Income Tax Appellate Tribunal (ITAT), High Courts, and the Supreme Court. - Cutoff Date for Pending Disputes

To be eligible, the tax dispute must be pending as of the cutoff date outlined by the government in the scheme’s notification. This ensures that taxpayers with ongoing litigation as of that date can settle their cases under this scheme. - Non-Eligibility for Certain Cases

Some cases are excluded from the scheme. These may include disputes related to serious offenses such as tax evasion, cases involving criminal charges, or black money-related offenses. Taxpayers involved in such cases will not be eligible to apply. - Taxpayers with Pending Appeals

Taxpayers who have appeals pending in any court, tribunal, or appellate authority can apply under this scheme. Even those whose cases are in arbitration can opt for settlement under DTVSV 2024. - Disputes with Reduced Liabilities

The scheme offers reduced settlement amounts for disputes where the taxpayer has already made partial payments. This is applicable for cases where a part of the tax demand has already been cleared, reducing the amount payable under the scheme.

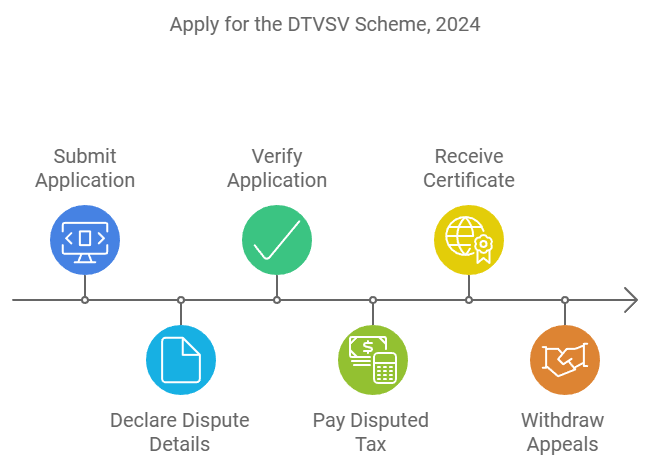

Procedure for Filing Under DTVSV Scheme, 2024

The process to apply for settlement under the Direct Tax Vivad se Vishwas Scheme (DTVSV), 2024 is designed to be straightforward and accessible to all eligible taxpayers. Here’s a step-by-step guide to filing under the scheme:

- Step 1: Application Filing

Taxpayers wishing to settle their disputes under the scheme must submit an application. The application can be filled online through the official Income Tax Department portal. The required forms are available for download or online completion. Ensure that all the necessary documents related to the tax dispute are ready before starting the application. - Step 2: Declaration of Dispute Details

As part of the application, the taxpayer must declare the details of the dispute they wish to settle. This includes the nature of the dispute, the amount of tax under dispute, and any payments already made toward the tax demand. It is important to be accurate and transparent while declaring the details, as discrepancies may result in the rejection of the application. - Step 3: Verification by the Authorities

Once the application is submitted, the tax authorities will review the details of the dispute and verify the application. This verification process is meant to ensure that the dispute qualifies under the eligibility criteria of the scheme. Taxpayers can track the status of their application online through the portal. - Step 4: Payment of Disputed Tax

After the application is verified and accepted, the taxpayer must make the necessary payment toward the disputed tax amount. The scheme provides options to pay online through various payment methods, making it convenient for taxpayers to comply. - Step 5: Issuance of Certificate

Upon successful payment and compliance with all the required steps, the tax authorities will issue a certificate confirming the resolution of the dispute. This certificate acts as proof that the case has been settled under the DTVSV Scheme, 2024, and the taxpayer will no longer face any further litigation for that dispute. - Step 6: Withdrawal of Appeals

Once the settlement is confirmed, taxpayers who have filed appeals or litigation regarding the disputed amount are required to withdraw their appeals from the relevant courts or tribunals. This ensures that the settlement under DTVSV is final, and there are no further disputes regarding the same issue.

Benefits of the DTVSV Scheme, 2024

The Direct Tax Vivad se Vishwas Scheme (DTVSV), 2024 offers several benefits, making it an attractive option for taxpayers with pending disputes. Here are the key advantages of opting for the scheme:

- Reduction in Litigation

One of the primary benefits is the reduction in prolonged litigation. By opting for the scheme, taxpayers can resolve their disputes without the need for extended court battles, saving both time and legal costs. The scheme simplifies the process, offering a faster resolution to tax disputes that would otherwise take years. - Waiver of Penalty and Interest

A significant incentive under the DTVSV Scheme, 2024, is the waiver of interest and penalties. Taxpayers are required to pay only the disputed tax amount, without the burden of additional penalties or interest, provided they comply within the given deadlines. This substantially reduces the financial burden on taxpayers. - Incentives for Early Settlement

The scheme encourages taxpayers to settle disputes early by offering further reductions in the payable amount if they opt for the scheme within the prescribed timeframe. Early settlement can lead to lower amounts payable, which is a compelling reason for taxpayers to resolve their disputes quickly. - Clarity and Finality

Once a dispute is settled under the scheme, it is considered final. Taxpayers receive a certificate from the tax authorities confirming that the matter has been resolved. This brings clarity and peace of mind, as the taxpayer will no longer face any future litigation or inquiries regarding the settled dispute. - Restoration of Focus on Business or Other Priorities

Tax disputes can often be a distraction for businesses and individuals. By resolving disputes under the DTVSV Scheme, 2024, taxpayers can eliminate this ongoing concern and refocus their attention on core business operations or other personal priorities, free from the stress of unresolved tax matters. - Support for a Transparent Tax System

This scheme is part of the government’s broader effort to build a transparent and trustworthy tax system. By encouraging voluntary settlements, the DTVSV Scheme fosters a healthier relationship between taxpayers and tax authorities, paving the way for future compliance and cooperation.

Timeframes and Deadlines

To take full advantage of the DTVSV Scheme, 2024, it is crucial for taxpayers to be aware of the timelines and deadlines associated with the scheme. Missing these key dates could result in the taxpayer losing out on the benefits offered.

- Filing Deadline for Applications

Taxpayers must submit their applications under the DTVSV Scheme, 2024, by the deadline specified by the government. Typically, the deadline is set for a few months after the launch of the scheme, allowing taxpayers ample time to gather documents and complete the application process. - Payment Deadline

Once the tax authorities verify and accept the application, the taxpayer must make the necessary payment toward the disputed tax amount within the stipulated timeframe. The earlier the payment is made, the more likely the taxpayer is to benefit from reduced payable amounts under the scheme’s incentives for early settlement. - Timeline for Verification by Authorities

After submission, the tax authorities typically take a set period to verify the details of the dispute and the taxpayer’s application. While this process is streamlined, it is advisable for taxpayers to keep track of their application status online. - Withdrawal of Appeals

Once the dispute is settled and payment is made, taxpayers who have pending appeals in court or before any tax tribunal must withdraw their appeals within a specified timeframe. Failure to do so could lead to complications, and the settlement may not be considered final. - Extension Possibilities

While the government generally sets firm deadlines for the scheme, it is possible that extensions may be granted under special circumstances. In the past, similar schemes have seen deadline extensions to accommodate more taxpayers. However, relying on an extension can be risky, and it is always advisable to complete the process within the original timeframe. - Consequences of Missing Deadlines

If a taxpayer fails to meet any of the prescribed deadlines, such as application submission or payment, they will no longer be eligible to settle their disputes under the DTVSV Scheme, 2024. In such cases, the taxpayer may need to continue with the litigation process in courts or tribunals, missing out on the benefits of the scheme.

Payment Terms and Calculations

Under the DTVSV Scheme, 2024, taxpayers must make payments according to specific terms, depending on the nature of their tax disputes and the stage of their cases. The scheme offers attractive payment options, especially for those who settle early. Here’s a breakdown of the key payment terms:

Final Settlement and Receipt of Certificate

Once the payment is made, the tax authorities will verify the payment and issue a settlement certificate. This certificate confirms that the taxpayer’s dispute has been resolved, and no further litigation will take place concerning the matter.

Disputed Tax Amount

Taxpayers are required to pay only the principal disputed tax amount. The scheme provides full waivers on interest and penalties, making it significantly easier for taxpayers to clear their liabilities. The exact disputed tax amount is determined based on the pending assessments or demands raised by the tax authorities.

Reduced Settlement Amounts for Early Resolution

One of the key incentives for taxpayers is the reduced settlement amounts for disputes settled within a specified timeframe. If taxpayers file their application and make the payment early, they can avail of additional concessions, further reducing their financial liability under the scheme.

Partial Payments Already Made

For taxpayers who have already made partial payments toward the disputed tax amount before opting for the scheme, the amount payable is reduced accordingly. They will only need to pay the outstanding balance of the disputed tax, without any interest or penalties.

Payment for Appeals Involving Penalties or Interest Only

In cases where the appeal pertains solely to interest or penalty (i.e., there is no dispute over the principal tax), taxpayers can settle by paying a percentage of the disputed interest or penalty amount. The exact percentage is outlined in the scheme, and typically involves a substantial reduction to encourage taxpayers to settle.

Flexible Payment Methods

The scheme allows payments to be made through various online methods, including net banking, credit cards, and other digital payment options. This makes the process smooth and user-friendly, encouraging wider participation from taxpayers.

Comparison Between DTVSV 2020 and DTVSV 2024

While both the Direct Tax Vivad se Vishwas (DTVSV) schemes of 2020 and 2024 share a common goal of reducing litigation and providing a simpler mechanism for tax dispute resolution, there are notable differences between the two versions. Here’s a comparison of the key aspects:

| Aspect | DTVSV 2020 | DTVSV 2024 |

|---|---|---|

| Scope of Coverage | Covered a broad range of disputes involving direct taxes (income tax, wealth tax, surcharges). Focused on reducing litigation backlog. | Expands coverage to include more taxpayers and disputes, allowing for wider settlement opportunities. |

| Eligibility Criteria | Applicable to disputes pending as of January 31, 2020. | Applicable to disputes pending as of a new cutoff date specified by the government. |

| Incentives for Early Settlement | Waivers on penalties and interest for early settlements within prescribed deadlines. | Continues similar incentives, with additional structured reductions for timely settlements. |

| Simplified Process | Introduced online filing for easier access to the scheme. | Further simplifies the process with more digital tools and payment options for a user-friendly experience. |

| Appeals and Withdrawals | Required taxpayers to withdraw pending appeals after settlement. | Retains the requirement for withdrawing appeals but streamlines the withdrawal process for quicker resolution. |

| Impact on Pending Cases | Significantly reduced pending cases in appellate forums, speeding up resolution. | Aims to reduce newer disputes that have arisen after the 2020 scheme, expected to further clear the backlog. |

| Government Revenue | Helped recover a substantial amount from disputed taxes, boosting government revenue. | Expected to build on the success of the 2020 scheme, with potentially higher recovery from a broader scope of disputes. |

Impact on Taxpayers

The DTVSV Scheme, 2024 is designed to significantly benefit taxpayers by providing an opportunity to resolve disputes efficiently. Here’s how the scheme impacts different types of taxpayers:

- Financial Relief Through Waivers

One of the most immediate impacts is the financial relief provided by the waiver of interest and penalties. For taxpayers with long-pending disputes, these waivers can reduce their total tax liability significantly. By only requiring payment of the disputed tax amount, the scheme lightens the financial burden on taxpayers, making settlement an attractive option. - Faster Resolution of Disputes

Taxpayers no longer need to wait for years for their cases to be resolved through the traditional litigation process. The scheme ensures that disputes are settled within a defined timeframe, giving taxpayers peace of mind and allowing them to focus on other business or personal priorities. This faster resolution also reduces the stress and uncertainty of ongoing litigation. - Incentives for Early Settlement

For taxpayers who opt to settle their disputes early under the scheme, additional financial benefits are available. These incentives encourage taxpayers to act quickly and finalize their disputes at a reduced cost. The availability of such benefits makes the scheme even more appealing for taxpayers seeking quick relief. - Opportunity to Clear Long-Standing Cases

Many taxpayers have disputes pending for years, often involving complex cases that are difficult to resolve. The DTVSV Scheme, 2024, offers a once-in-a-lifetime opportunity for taxpayers to close these long-standing disputes, allowing them to clean up their financial records and move forward without the burden of unresolved cases. - Boost to Taxpayer-Government Relationship

The scheme also improves the relationship between taxpayers and tax authorities by encouraging voluntary compliance and promoting a more collaborative approach to resolving disputes. This paves the way for better communication and cooperation in future tax matters, creating a more transparent and efficient tax system. - Potential for Tax Savings

Taxpayers who take advantage of the scheme can potentially save on their total tax payments, especially when waivers of penalties and interest are considered. For many, this leads to substantial tax savings, further incentivizing participation in the scheme. - Impact on Businesses

For businesses, especially those with large tax disputes, the scheme offers a path to resolving financial uncertainty. Settling disputes under the scheme allows businesses to avoid prolonged litigation, helping them maintain better financial health and focus on growth. This resolution of disputes also has a positive effect on business operations, creditworthiness, and investor confidence.

Criticisms or Limitations of the DTVSV Scheme

While the DTVSV Scheme, 2024 offers numerous benefits, it is not without its criticisms and limitations. Understanding these can help taxpayers make informed decisions about whether to participate in the scheme:

- Not Suitable for All Disputes

The scheme does not cover all types of disputes, particularly those involving serious offenses such as tax evasion or black money. Taxpayers with disputes related to criminal offenses or those that fall outside the scope of the scheme will not be able to participate, leaving them to continue with litigation. - Limited Relief for Certain Cases

For some taxpayers, particularly those who have already made significant payments toward their disputed taxes, the financial relief offered may seem minimal. In cases where only a small portion of the tax remains unpaid, the savings from waivers on interest and penalties might not be substantial enough to make the scheme appealing. - Short Application Window

The timeline for applying and making payments under the scheme is typically tight. Taxpayers may feel pressured to meet deadlines, especially if they have complex disputes that require careful consideration. Missing the deadline could mean losing out on the scheme’s benefits and having to resume litigation. - Uncertainty for Ongoing Cases

Taxpayers with disputes pending at various stages may find it difficult to decide whether to opt for settlement or wait for the outcome of their appeals. The uncertainty around ongoing litigation can create a dilemma, as the potential for a favorable court ruling might outweigh the benefits of settling under the scheme. - Potential for Repetition

Some critics argue that schemes like DTVSV, while beneficial, may encourage a cycle of litigation and settlement offers. Taxpayers might delay paying taxes with the expectation that similar schemes will be introduced in the future, allowing them to settle disputes with waivers again. - Administrative Challenges

Although the scheme simplifies the dispute resolution process, there may still be administrative hurdles in verifying applications, calculating disputed tax amounts, and ensuring timely payments. For some taxpayers, navigating these bureaucratic processes can be frustrating, potentially leading to delays or errors. - Limited Public Awareness

Not all taxpayers may be aware of the scheme or fully understand its benefits. The success of the scheme relies heavily on public awareness and education, and without effective communication from the government, some eligible taxpayers may miss out on the opportunity to settle their disputes.

Frequently Asked Questions (FAQs)

To help taxpayers better understand the DTVSV Scheme, 2024, here are answers to some common questions:

- Who is eligible to apply for the DTVSV Scheme, 2024?

Any taxpayer involved in a direct tax dispute, including individuals, companies, HUFs, partnerships, and trusts, can apply. The dispute must be pending as of the cutoff date specified by the government. - What types of disputes are covered under the scheme?

The scheme covers disputes related to direct taxes such as income tax, wealth tax, and other related surcharges. It includes disputes pending before appellate authorities like the Income Tax Appellate Tribunal (ITAT), High Courts, and the Supreme Court. - What benefits do taxpayers receive by opting for the scheme?

Taxpayers benefit from waivers on penalties and interest, and they are required to pay only the disputed tax amount. Early settlements can also lead to further reductions in the amount payable. - How can I apply for the scheme?

Taxpayers can apply through the Income Tax Department’s official portal. The application process is entirely online, and the required forms and documents can be submitted digitally. - What happens if my application is rejected?

If your application is rejected, you may have to continue with the litigation process in the courts or tribunals. It is essential to ensure that all details in the application are accurate to avoid rejection. - Can disputes related to criminal tax offenses be settled under the scheme?

No, disputes involving serious offenses like tax evasion or black money are excluded from the scheme. Taxpayers with such disputes are not eligible to apply. - Is there a deadline for applying under the scheme?

Yes, the government will specify a deadline for filing applications and making payments under the scheme. Taxpayers must complete the process before this deadline to benefit from the scheme. - What if I have already made partial payments towards my disputed tax?

If you have made partial payments, the amount payable under the scheme will be reduced by the amount already paid. You will only need to pay the remaining balance of the disputed tax. - Will I need to withdraw any pending appeals after settling my dispute?

Yes, once you have settled your dispute under the DTVSV Scheme, 2024, you are required to withdraw any appeals or litigation related to that dispute. This ensures that the settlement is final. - Can the government extend the deadline for the scheme?

While the government generally sets firm deadlines, extensions may be granted under special circumstances. However, it is advisable to complete the process within the original timeframe to avoid missing out on the benefits.

Conclusion

The Direct Tax Vivad se Vishwas Scheme (DTVSV), 2024 is an initiative aimed at easing the burden of tax litigation in India. By offering taxpayers a chance to settle disputes with significant waivers on penalties and interest, the scheme provides a unique opportunity for financial relief and quicker resolutions. It also contributes to a more transparent and collaborative relationship between taxpayers and tax authorities.

For those with pending disputes, opting for the DTVSV Scheme, 2024, could mean a fresh start—eliminating prolonged litigation, reducing tax liabilities, and restoring focus on business and personal priorities. However, it’s essential to carefully consider eligibility, deadlines, and the benefits offered under the scheme to ensure it’s the right choice.

With proper planning and timely application, taxpayers can take full advantage of this initiative and close their tax disputes with peace of mind.