Need for allowing exemption from filing Income Tax Return for employees having income or loss on House Property

Income Tax Department has issued Notification No: 9/2012 F. No.225/283/2011-ITA(II) dated 17-2-2012, for exempting filing of Income tax Return for the financial Year 2011-12 (Assessment Year 2012-13).

Update: 25th September 2017: Income Tax Exemption on Interest Paid on Housing Loan – Capped at Rs. 2 lakh for rented property also

This exemption will be applicable for an individual whose total income for the relevant assessment year does not exceed five lakh rupees and consists of only income chargeable to income-tax under the following head,-

(A) “Salaries”;

(B) “Income from other sources”, by way of interest from a saving account in a bank, not exceeding ten thousand rupees.

The other conditions stipulated for availing this exemption are

(i) has reported to his employer his Permanent Account Number (PAN);

(ii) has reported to his employer, the incomes mentioned in sub-para (B) of para 1 and the employer has deducted the tax thereon;

(iii) has received a certificate of tax deduction in Form 16 from his employer which mentions the PAN, details of income and the tax deducted at source and deposited to the credit of the Central Government;

(iv) has discharged his total tax liability for the assessment year through tax deduction at source and its deposit by the employer to the Central Government;

(v) has no claim of refund of taxes due to him for the income of the assessment year, and

(vi) has received salary from only one employer for the assessment year.

No Change in the conditions imposed in the last year:

It is seen that conditions for availing exemption from filing of Income tax Return, such as income cap of Rs.5 lakhs, income only from salaries and interest, involvement of no refund claim, salary from only one employer etc., existed last year also, and there is no change as well as no new conditions this year.

Saving under Section 80 C and Deductions under Chapter VIA allowed to be deducted:

Though it is not specifically mentioned in the Notification for exemption this year as well as last year, Income tax Department clarified by way of issuing Frequently Asked Questions (FAQ) in its website to the extent that Total income for claiming exemption is the income after taking in to account viz., after deducting the savings up to Rs.1 lakh under Section 80C and and also after deducting the Chapter VI A exemptions such as Health Insurance Premium under Section 80D. The text of the said Clarifications reads as follows.

For Example –

(i) If an individual has salary income of Rs. 4,90,000 and interest income from savings bank account not exceeding Rs. 10,000 (which has been reported to the employer and tax has been deducted thereon), then the taxpayer would be exempt from the requirement of filing income-tax returns since the total income from both the above sources does not exceed five lakh rupees.

(ii) A taxpayer having salary income of Rs. 4,98,000 and interest income from savings bank account of Rs. 2,000 (which has been reported to the employer and tax has been deducted thereon), would also be eligible under this Scheme.

(iii) A taxpayer having salary income up to Rs. 5,00,000 and nil interest income would also be eligible under this Scheme.

(iv) A taxpayer having salary income of Rs. 5,50,000, interest income from savings bank account of Rs. 8,000(which has been reported to the employer and tax has been deducted thereon), and who has claimed deduction of Rs. 70,000 under section 80C (on account of certain payments/investments/savings) would also be eligible under the Scheme.

(v) A taxpayer having salary income of Rs. 6,10,000, interest income from savings bank account of Rs. 10,000 (which has been reported to the employer and tax has been deducted thereon), and who has claimed deduction of Rs. 1,00,000 under section 80C (on account of certain payments/investments/savings), a deduction of Rs. 20,000 under 80CCF (Infrastructure Bonds) and a further deduction of Rs. 15,000 under section 80D (Health Insurance Premium) would also be eligible under the Scheme.

Read the following GConnect article that discusses this Frequently Asked Questions in detail.

Income Tax releases FAQ on Exemption from filing of Income Tax Return

Total Income in the Notification implies Taxable Total Income:

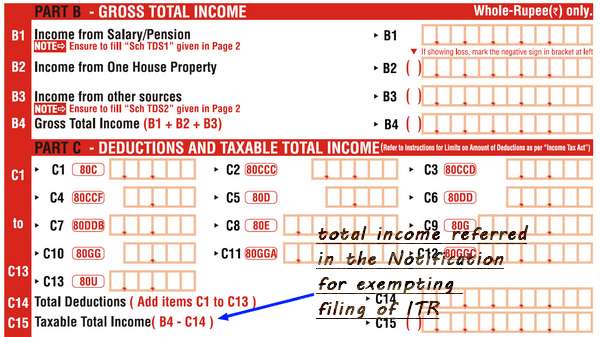

This clarification implies that the total income referred to in the notification is the Taxable Total Income after all deductions. The following snapshot of ITR-1 return will indicate the same and the total income referred to in the notification is C15 (Taxable Total Income).

However, the notification and Income Tax Department’s clarification are silent this year also as far as the income/loss from house property is concerned, which will be deducted well before arriving the Taxable Total Income (C15).

No proper clarification for income or loss on House Property with respect to IT return exemption:

Most of the salaried employees would have received house loan and will be claiming rebate on interest paid on House property which will be coming under the head “income or loss on house property”. Further, receipt of small amount of rent from the said house property would make them out of the purview of the exemption notification as filing of IT return is exempted only for the income from salaries and Interest.

Having allowed the savings under Section 80 C and deductions under Chapter VI A to be deducted for the purpose of exemption from filing IT return last year, the query that “Whether the Rs. 5 lakhs exemption limit referred to in the Notification is after deducting the interest/loss on house property” was not properly clarified.

The other query that whether by receipt of small amount of rent from the house property (including which the salary income does not exceed Rs.5 lakh), the individual will be ineligible for exemption from filing IT return, was also not clarified by the IT department.

This resulted in confusion and the employees who did not cross the Rs. 5 lakh limit after deducting interest on house property and also the employees whose salary income including the rental income from house property did not exceed Rs. 5 lakh had to file Income tax return.

Need for allowing Exemption:

It is high time to issue proper clarification in this regard. We feel that having allowed all deductions under Section 80 C and Chapter VI A, the income/Loss on house property should also be allowed to be deducted before arriving the exemption limit of Rs. 5 lakh for the purpose of filing of Income Tax Return.