How to file Income Tax Return Online?

Salaried employees having income between Rs. 5 lakh and Rs.10 lakh can file their Income Tax return either in manual mode or through electronic mode (e-filing) while filing of ITR in respect of salaried employees is exempted if their gross total income is less than Rs. 5 lakh with in which the interest from bank deposits did not exceed Rs.10,000. Check our previous article on release of ITR-1 and ITR-2 forms by Income Tax Department

E-filing of Income Tax return:

E-filing of Income Tax Return using the Income Tax Department website is easier provided you follow the procedures carefully

Find Which ITR to be filed by you first:

The following table will be useful for choosing the ITR form required to be filed by a Salaried Employee.

| Form Type | Who can use this form |

|---|---|

| ITR-1 | This Return Form is to be used by an individual whose total income for the assessment year 2012-13 includes:- (a) Income from Salary/ Pension; or (b) Income from One House Property (excluding cases where loss is brought forward from previous years); or (c) Income from Other Sources (excluding Winning from Lottery and Income from Race Horses) |

| ITR-2 | This Return Form is to be used by an individual or a Hindu Undivided Family whose total income for the assessment year 2012-13 includes:- (a) Income from Salary / Pension; or (b) Income from House Property; or (c) Income from Capital Gains; or (c) Income from Other Sources (including Winning from Lottery and Income from Race Horses).. Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used where such income falls in any of the above categories. |

Requirements for filing ITR online:

1. User ID (Which will be your PAN) and a password to file Income Tax Return online in the IT department Website. You have to register using your PAN in the Income Tax Website (https://incometaxindiaefiling.gov.in) to get this password.

2. Form 16 issued by your Employer or Income Tax Statement furnished by you to your employer for declaring the deductions and savings eligible to you (Though you need not file these documents with Income Tax department, for the purpose of entering the details to generate ITR online all the income and deduction details found in Form 16 or Income Tax Statement will be required.

To generate income tax statement for financial year 2011-12 (assessment year 2012-13) use this GConnect Online Income Tax Calculator and Statement Generator Tool Methods of filing online ITR

When an individual filing ITR online using Income Tax website, he/she can do so either without digital signature or with digital signature. Filing of ITR with Digital signature has only one advantage. The printout of e-filed return (ITR-V) need not be sent in case of an individual having digital signature.

However obtaining digital signature is a separate process through certain approved agencies, which would involve separate cost. The issuance costs in respect of each Certification Agency vary and are market driven. If we submit the ITR online without digital signature, process is same with an additional procedure involving sending a signed print out of ITR-V (The document that is generated once we file ITR-1 or ITR-2 online is called ITR-V) to Central Processing Center, IT Department, Bangalore.

E-filing of ITR through Intermediaries is the other method, for which details are to be furnished to intermediary who will generate and submit ITR on your behalf to IT Department.

Steps for filing ITR Online

1. Download ITR-Return preparation Software provided by Income Tax Department, which is nothing but an Excel work sheet. This excel file can be downloaded using the following link.

Download ITR-Return preparation software

2. Once this excel file is downloaded enter your income and deduction details in the same and use validate button. Once you clicked the validate button an xml file containing your income and deduction details will be generated and will be stored in your computer in the folder/drive of your choice.

3. Go to Income Tax Department website for filing income tax (https://incometaxindiaefiling.gov.in) and select the assessment year (2012-13) in the “Submit Return” menu. In the Login Screen follows provide your PAN as user id and password allotted by while registration.

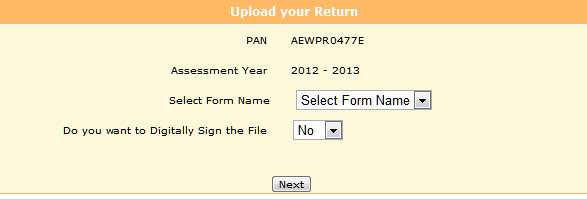

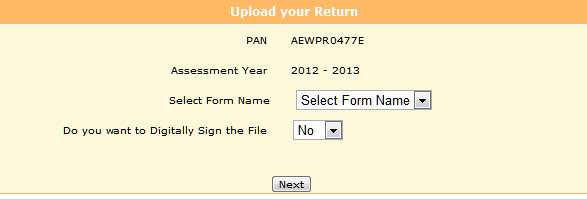

4. After you are logged in the following screen will appear which will ask for type of ITR to be filed. Choose relevant ITR ( ITR-1 or ITR-2 based on your income pattern). Also opt for filing ITR with or without digital signature and click next.

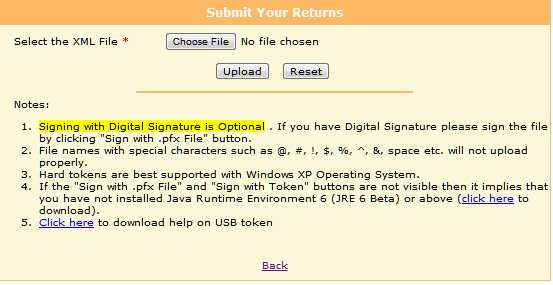

5. Now the you will be required to upload the xml file generated by you using the excel file, which contain your income and deduction details. Once this xml file is uploaded acknowledgement details would be displayed. Click on “Print” to generate printout of acknowledgement/ITR-V Form.

6. In case the return is digitally signed, on generation of “Acknowledgement” the Return Filing process gets completed. You may take a printout of the Acknowledgement for your record.

7. Incase the return is not digitally signed, on successful uploading of e-Return, the ITR-V Form would be generated which needs to be printed by the tax payers. This is an acknowledgement cum verification form.

8. A duly signed ITR-V form should be mailed to “Income Tax Department – CPC, Post Bag No – 1, Electronic City Post Office, Bengaluru – 560100, Karnataka, ” BY ORDINARY POST OR SPEED POST ONLY within 120 days of transmitting the data electronically. ITR-V sent by Registered Post or Courier will not be accepted.

The following presentation is an interactive presentation on procedures to be followed for E-filing of ITR Return

These are links of Income Tax Department which explain E-filing of Income Tax Return

In the downloaded excel sheet for ITR 1, where do I fill deduction allowed for Children Education Allowance i.e. under IT sec 10(14) ii

Please help.

It has to deducted under the tuition fees. There will not be any separate field for Tuition fees. You have to take that in to account along with your savings under Section 80 C. Section 80 C deductions has a separate field in ITR

the tds page in ITR2 is asking for an 8 digit TDS certificate number . it is actually of 6 alphabets only. please guide what to do