E-filing ITR – Steps to register at Income Tax website for filing Income Tax Return Online

E-filing ITR – Steps to register at Income Tax website for filing Income Tax Return Online – Filing ITR online is compulsory for tax payers with total income exceeding Rs. 5 lakh

Income Tax Department has made all the provisions for filing ITR Online (e-filing of Income Tax Return for the year 2014-15 – (Assessment Year 2015-16) in its official online filing website – https://incometaxindiaefiling.gov.in

It has also uploaded necessary ITR forms such as ITR-1, ITR-2, ITR-2A, ITR-4, ITR-4S etc which are meant for declariing

Taxable Income and Income Tax Paid in respect of salaried Employees and Individuals for the financial year 2014-15 who are entitled to file paper form of ITR (Manual IT return)

Click here to download ITR-1, ITR-2, ITR-2A (Paper Form)

Who should file ITR Online this Year ?

As per the instructions issued by Income Tax Departemnt which are effective for the income earned in the financial Year

2014-15, an individual who has total income (taxable income) exceeding Rs. 5 lakh or needs to file a refund claim in ITR, will have to file relevant Income Tax Return online (e-filing of ITR)

Checkout this link for more details on requirement of filing ITR Online by Tax Payers

Which ITR form should I file this year ?

Among ITR-1, ITR-2, ITR-2A and ITR-4S which are meant for Tax Paying Individuals, the appropriate ITR should be chosen on the basis of type of income and deductions such as interest on house property etc.

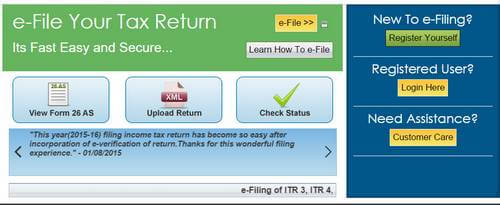

Once appropriate ITR to be filed is chosen, click the following link to reach e-filing website of IT department

Click here to reach incometax e-filing website

Steps to register at Income Tax E-Filing Website:

1. Click the register yourself button in the home page of E-filing website.

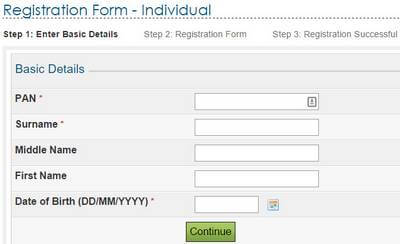

2. In the registration form page that is open now, select typer of tax payer option (In repect of Salaried Employees check the “individual” option.

3. In the next window, you have to enter PAN, surname / last name, Middle Name, First name and Date of Birth which are available in the PAN Card. Out of these fields, PAN, surname / last name and Date of Birth are mandatory. As the first name, middle name and last name that you enter now should match with the data which are available in Income Tax Database as against your PAN, if you make a change in order of these names system would not accept your registration.

4. In order to find out surname / last name available in PAN database, check the 5th digit in PAN structure

Example PAN : ABCDE1234F

In the above example 5th digit is “E”. So,the surname / last name of the PAN holder as per the PAN database will be a name that starts with the letter “E”. By this method given 3 names viz., Fist name, middle name and Surname / last name of PAN Holder, we can easily findout which is the surname of the said PAN holder as per PAN database. Only this name has to be entered in Surname field in the registration procedure for filing ITR. As first name and middle name are only optional, we can leave these fields as blank if any error message is shown as far as first and middle names are concerned.

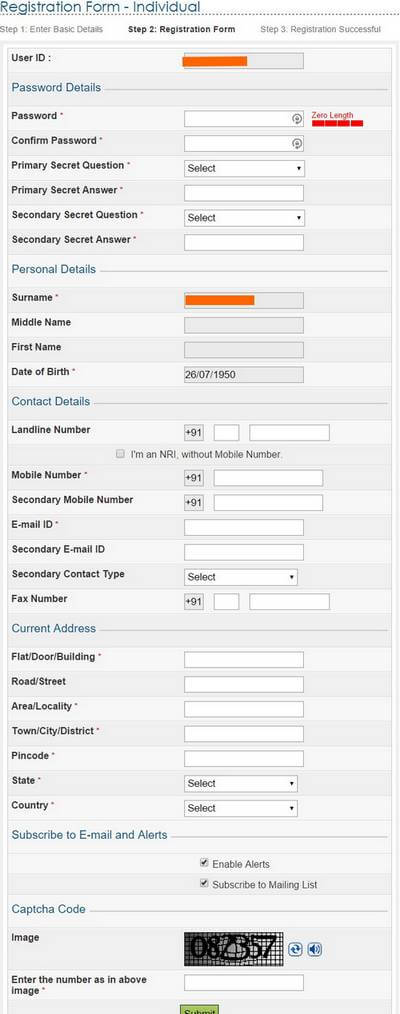

5. After successfully entering names and date of birth, a detailed registration form will have to be filled up in the next screen.

Following details will have to be filled up in Registration Form

a) User ID (ten digit PAN)

b) password (conditions for setting password are given in detail in this screen)

c) Primary and secondary secret questions will have to be selected and answers for the same will have to be filled up.

d) Contact Land Line (optional)

e) Mobile Number (mandatory)

f) E-mail ID (Mandatory)

g) Present Address

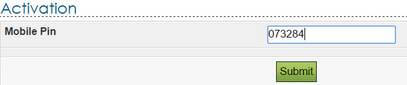

6. After submitting these details, transaction ID will be displayed in the screen. Email ID and mobile number to which activation links and code are sent respectively will be available. Check the relevant mobile for SMS with a code received from Income Tax Department. Enter the said Code in the window that is opened once you click the activation link in the email received in your Inbox.

7. You will get a message in a new window as “The User ID is successfully activated.

Now, you can file your ITR online after logging in to ITR e-filing website using the your PAN as user name and chosen password.

In the case of ITR-1 or ITR-4S, Income Tax Department has provided online data entry interface that is very user friendly. This is called as “Quick e-file ITR”. In this facility data on income and deductions can be filled up online in the field given and there is no need for downloading any Excel or java utility for off-line data entry and uploading of resultant xml file in e-filing website as in the case of ITR-2 and ITR-2A.

Click here know about using Quick e-file ITR facility

If you intend to utilize the off-line excel or java utility for entering your tax related data and then upload the same in income tax e-filing website, check the following link which contains all information for partial off-line method for filing ITR

Click here get the step by step procedure to use java or excel utility filing Income Tax Return

Also checkout following link for all information on Income Tax applicable to Salaried Employees.

Click here for Income Tax Reference Page (All Information on Income Tax for Salaried Employees)

📢 Stay Updated with GConnect

Join our Whatsapp channels for the latest news and job updates:

Join GConnect News Join GConnect JobsGConnect News

GConnect Jobs

You might also like:

30% LDCE CBT for Group ‘B’ Promotions on Railways to Be Held on 12 & 19 April 2026

8th CPC invites applications for 11 posts on Deputation Basis

DoPT Invites Applications from Retired Officers for Engagement as Legal Consultants

Retired Gazetted Officers Wanted as Consultants in Passport Offices

8th CPC MyGov Survey: What the 18 Questions Reveal About Pay Reform

So What’s the Real Story with the 8th Pay Commission?