Know what is the latest income tax rate and how are they calculated

After NDA 2.0 back in India, now the focus has shifted towards full and final Budget presentation for FY20 in July 2019. During the interim Budget, there was an eruption of joy among taxpayers as interim Finance Minister Piyush Goyal proposed that those who have a Rs 5 lakh income, will not have to pay tax. Standard deduction limit too was raised up to Rs 50,000 from previous Rs 40,000. However, the tax rebate on income upto Rs 5 lakh was brought under section 87A. However, to clear confusion know what is the latest income tax rate you pay and how are they calculated below and above Rs 5 lakh.

Income tax rates for salaried employee below 60 years of age – stands NIL on below Rs 2.5 lakh income, 5% between Rs 2.5 lakh to Rs 5 lakh income, 20% between Rs 5 lakh and Rs 10 lakh income and 30% above Rs 10 lakh income.

Archit Gupta, Founder & CEO ClearTax post interim budget said, “Those with income exceeding Rs 5L will pay tax on income between Rs 2.5L-5L @ 5% as before. Taxpayers with total income not in excess of Rs 5L will be offered rebate of zero tax via section 87A.”

Meanwhile, for senior citizens aged 60 years but less than 80 years, a tax rate of 5% is applicable on income from Rs 3 lakh to Rs 5 lakh. While below Rs 3 lakh, there are no taxes. As for income from Rs 5 lakh to Rs 10 lakh and above – tax rates of 20% and 30% is levied.

For senior citizens at and above 80 years of age, there are nil taxes for income upto Rs 5 lakh. Tax slab of 20% and 30% is applicable on income from Rs 5 lakh to Rs 10 lakh and above Rs 10 lakh.

Here’s how your income tax is calculated. Let’s find out with an example by ClearTax.

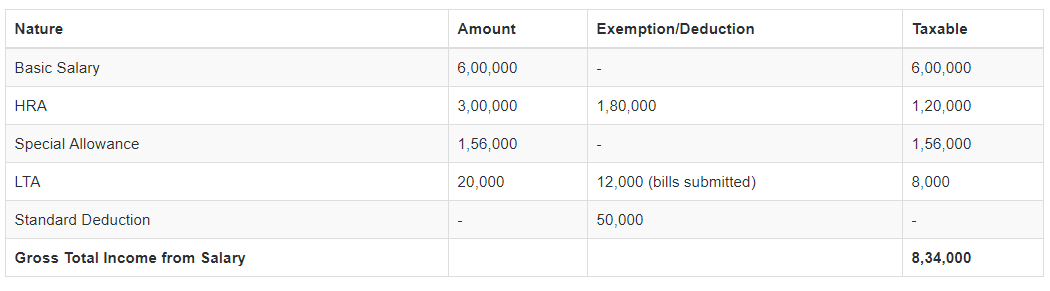

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

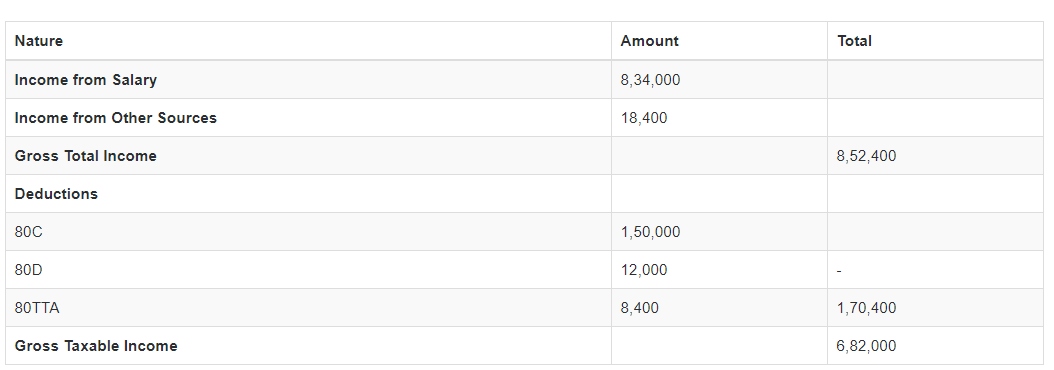

Let’s understand income tax calculation by way of an example. Neha receives a Basic Salary of Rs 50,000 per month. HRA of Rs 25,000. Special Allowance of Rs 13,000 per month. LTA of Rs 20,000 annually. Neha pays a rent of Rs 20,000 and lives in Delhi.

Calculation of gross taxable income in India

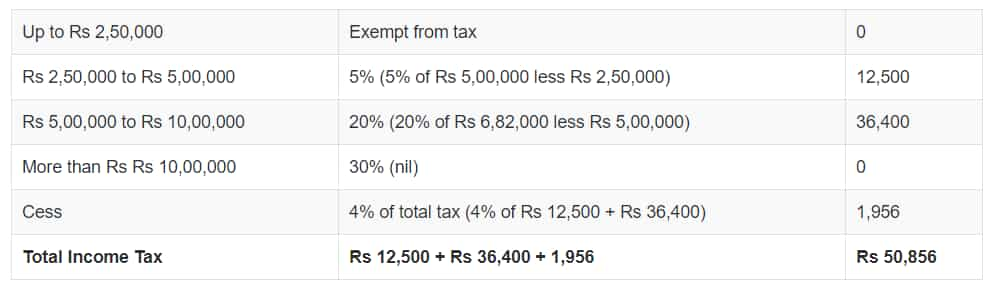

Income tax in India for Neha:

Currently, under section 87A of IT Act, a taxpayer can avail some tax relief who fall under the bracket of 10% rate or Rs 2,500 and earning up to Rs 3.5 lakh. However, it has now been proposed that, a taxpayer can avail tax rebate of Rs 12,500 from previous Rs 2,500. From Rs 3.5 lakh, this salary class has been increased up to Rs 5 lakh.

Hence, do not let confusion take place in your taxes. The IT-department has made it very easy and clear for citizens. Hence, make sure you are aware of your payslips and the pattern of taxes. It’s always wise to be an alert citizen, then a grumpy one on taxes!

This final budget announcement more clarification can be expected from NDA government in regards to income taxes.

Source: zeebiz