7th Pay Commission Pay and Allowances Calculator for Civilian Employees in Central Government

7th Pay Commission Pay and Allowances Calculator for New 7CPC Pay, HRA and TA as per the methods recommended for Central Government Civilian Employees

Update: 25.07.2016 :

Click here to reach 7th Pay Commission Pay Allowances Calculator based on Gazette Notification issued by Govt afer accepting7th CPC recommendations – GConnect Pay and Allowances Caculator with arrears calculation feature

Click here to calculate 7th Pay Commission Defence Pay Calculator with Arrears

Update : 08.12.2015: 7th Pay Commission Pay and Allowances calculator has been updated now for calculating 7cpc proposed NPA (Non-Practicing Allowance) applicable to Medical Doctors employed in Central Government Services.

Non-Practicing Allowance for Defence Medical Doctors:

7th Pay Commission has recommended that Defence Medical Doctors will be entitled to NPA of 20% calculated on 7CPC Basic Pay. Presently NPA is paid at the rate of 25% of Basic Pay.

NPA and MSP is not a pay for the purpose of HRA:

7th Pay Commission has observed that NPA and MST should not be taken in to account while calculating HRA. Presently, for the purpose of arriving at HRA, NPA and MSP are added with Basic Pay.

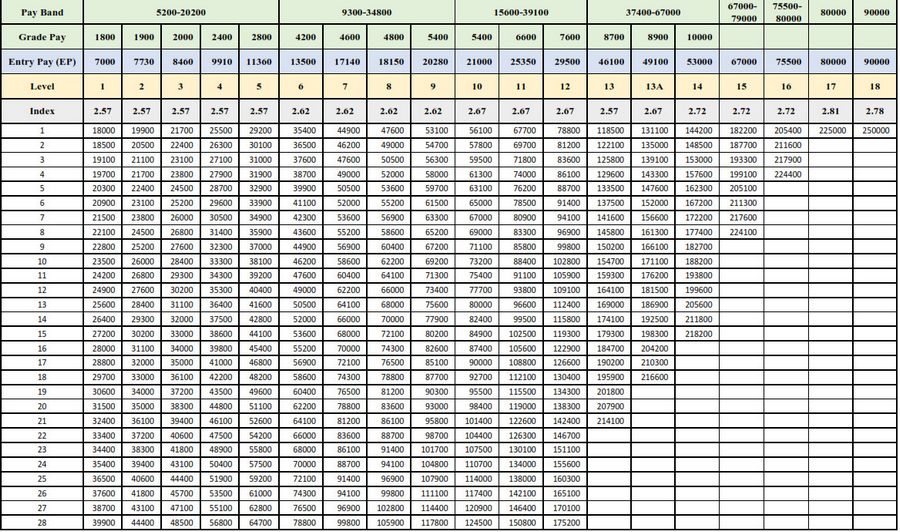

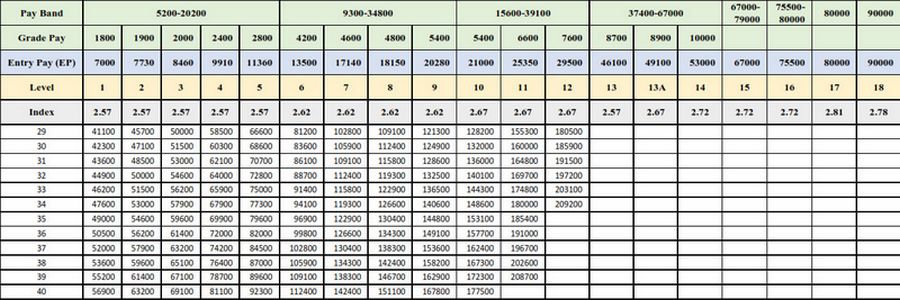

We have 7th Pay Commission Report in black and white now. The Commission has done away with the Pay Band – Grade Pay System for various reasons. A new Pay Matrix system introduced by the commission contains as many as 18 horizontal levels to take care of fixation of pay on MACP or Promotion. The vertical range for each of these 18 levels is meant for fixation of pay by providing annual increment. Taking all these aspects in to account GConnect has come up with 7th Pay Commission Pay and Allowances Calculator to determine 7th Pay Commission Pay, HRA and TA of Central Government Civilian Employees.

7th Pay Commission – Pay Matrix

Fixation of 7th CPC Pay for existing employees

Step 1: Identify Basic Pay (Pay in the pay band plus Grade Pay) drawn by an employee as on the date of implementation. This figure is ‘A’.

Step 2: Multiply ‘A’ with 2.57, round-off to the nearest rupee, and obtain result ‘B’.

Step 3: The figure so arrived at, i.e., ‘B’ or the next higher figure closest to it in the Level assigned to his/her grade pay, will be the new pay in the new pay matrix. In case the value of‘B’ is less than the starting pay of the Level, then the pay will be equal to the starting pay of that level.

Checkout this link for more details on 7th Pay Commission Pay Fixation Methods

HRA and Transport Allowance for Central Government Employees as recommended by 7th Pay Commission

HRA @ 24%, 16%, and 8% have been proposed for X, Y and Z class cities respectively. 7th Pay Commission has also recommended for enhancement of HRA while DA crosses 50% and 100%. As far as Transport Allowance is concerned, there is no increase. DA @ 125% has been merged with existing Transport Allowance

HRA recommended by 7th Pay Commission

Transport Allowance recommended by 7th pay Commission

How to use GConnect 7th Pay Commission Report Pay and Allowances Calculator ?

1. In the 6CPC Pay Entry Form, select the present pay band / Grade pay.

2. Enter your present pay in pay band, which will be the applicable 6CPC Pay as on 01.01.2016.

3. Select present 6CPC HRA percentage

4. Select the city in which you are posted for determining New TA

5. Click Calculate Button. Now New 7CPC Pay and Salary Benefit out of 7CPC wil be displayed in the 7CPC pay and allowance Table.

6. Click Show Entry Form Button to get the 6CPC Pay entry form back in the screen for using the calculator again.

[advanced_iframe securitykey=”ramansu6971″ src=”https://www.gconnect.in/pages/7cpcarrears/index.html” width=”100%” height=”1800px” ]

We request Readers to share this article to your friends and colleagues using Facebook or Google+ share buttons given below. This online tool will also be very useful to them in calculating their 7CPC pay and allowances