GConnect Income Tax Calculator with Save Option for 2015-16 (A.Year 2016-17) launched

GConnect Income Tax Calculator with Save Option for 2015-16 (A.Year 2016-17) – Calculate Income Tax to be paid for this year at ease

Following the launch of GConnect Instant Income Tax Calculator for this year, we have launched GConnect Income Tax Calculator with Save Option for the financial year 2015-16 ( Assessment Year 2016-17) today.

Following the launch of GConnect Instant Income Tax Calculator for this year, we have launched GConnect Income Tax Calculator with Save Option for the financial year 2015-16 ( Assessment Year 2016-17) today.

Save Option makes your job more easy:

Both of these Income Tax Calculators function in the same way except that income tax calculator with save option can be useful for entering income and deduction details in piece-meal and saving the same for generating final income tax statement on a later date. Save Option will be much handy as income and deduction details that are available now can be entered and saved in the tool and the remaining details can be entered as when those are available.

New features of Income Tax Calculator 2015-16:

1. Of course, this Income Tax Calculator has been developed taking in to account all the changes in income tax provisions for the year 2015-16.

2. Keeping in view with usage of more mobile and Tablet devices this new tool is fully responsive.

3. Tabbed view of the tool accommodates more information

4. All description / type of income, deduction and savings mentioned in the tool are provided with tool tips which contain detailed information. Point the mouse on the description with question mark to read those information.

5. Important Income Tax Provisions have been tagged with each description / type of income, deductions, and savings by way of hyperlink against each in a document icon, which will open relevant income tax provisions. For Example, if you need to verify the latest income tax provisions with respect to Section 80D concerned with deductions available on Health Insurance Premium, click the document icon against ‘Section 80D’ in Deductions Tab of Entry Form. This will open the Income Tax Provisions relating to Section 80D as a web page.

Click here to reach GConnect Income Tax Calculator with save option 2015-16 (Assessment Year 2016-17)

Click here to reach Instant GConnect Income Tax Calculator 2015-16 (Assessment Year 2016-17)

How to use GConnect Income Tax Calculator 2015-16 with save option?

This online tool has Four parts. 1. Login Form 2. Entry Form, 3. Work Sheet and 4. Income Tax Statement which will be generated in a different web page. Once you have successfully logged in to GConnect Income Tax Calculator with save option, other steps viz., Entry of income and deduction details, generation of Income Tax Work Sheet and generation of Income Tax Statement are similar to GConnect Instant Income Tax Calculator.

The additional feature provided in this online tool is the save option using which the users can save values after generating work sheet. Even if values for any of the Income, Deductions or savings are not known, enter known values, generate work sheet and then save the work sheet using the “Save Work Sheet” Button. Once values for remaining Income, Deductions or savings are available on a later date, enter the same, and generate work sheet again before saving the work sheet.

If you find that Income Tax work sheet which is generated is correct in all aspects, use generate statement button to for Final Income Tax Statement.

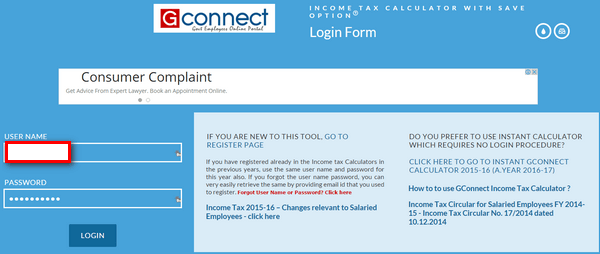

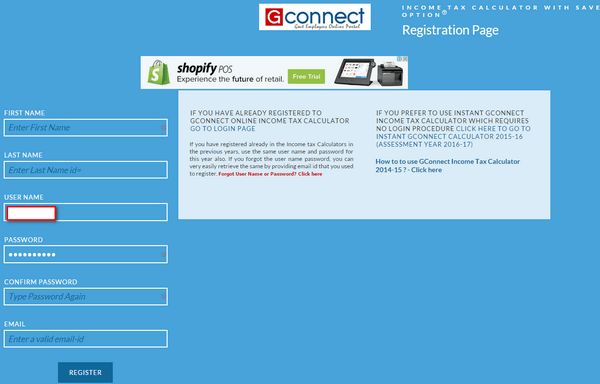

1. Login Page:

In order to save all values relating to income tax details of each and every user, this requires registration and login procedures.

Login using existing username and password if you have registered for GConnect Income Tax Calculator with save option. If you have forgot your user name or password you easily retrieve the same using “Forgot User Name or Password link” available in the login form. You can also register as new user through GO TO REGISTER PAGE Link which is available in the login page.

2. Entry Form: (With Five Tabs – Personal details, Income, Deduction, Savings and HBA)

Enter all your income, savings and deductions in the entry form and click get worksheet button.

3. Income Tax Work Sheet

Now, Income Tax Work Sheet would be generated below Entry form (after “Get work sheet” button). This Work sheet contains the following tabs

1. Month wise salary income,

2. One time income such as bonus etc., (Income Others)

3. HRA Exemption and TA Exemption

4. Summary of Deductions allowed under Section 10 and Chapter VIA

5. Section 80C, CCC, CCD savings

6. Gross Taxable Income

7. Taxable Income

8. Balance Income Tax Payable.

4. Income Tax Statement

Check the Income Tax Work Sheet by navigating to all these tabs. Once you have ensured that Income and Tax calculated are correct, click ‘Generate Statement’ Button to get Income Tax Statement along with Work Sheet (in 4 pages). Use “Print Statement” Button in the Statement page to get the same printed.

Requirement for Editing the Income Tax Work Sheet :

As far as Salary Income is concerned, this tool gets the monthly value of each type of income in the entry form. This value is used for preparing month wise salary income for the entire year in the Work Sheet.

In case, your pay in pay band, Grade Pay, TA, HRA etc changes in the middle of the month or year, due to promotion, MACP, transfer etc., Work Sheet can be edited manually for the respective period. In other words, you can modify all the individual fields in the work sheet to calculate revised tax. The revised tax will be calculated once you click out of the field you modified.

Check the following links for more details of on Changes in Income Tax Provisons in the year 2015-16

Provisions relating to Direct Taxes in Finance Bill 2015

Income Tax 2015-16 – Deductions and Exemptions for Salaried Employees

📢 Stay Updated with GConnect

Join our Whatsapp channels for the latest news and job updates:

Join GConnect News Join GConnect JobsGConnect News

GConnect Jobs

You might also like:

Promotion vs MACP: Why the Option Form You Sign Matters More Than You Think

30% LDCE CBT for Group ‘B’ Promotions on Railways to Be Held on 12 & 19 April 2026

8th CPC invites applications for 11 posts on Deputation Basis

DoPT Invites Applications from Retired Officers for Engagement as Legal Consultants

Retired Gazetted Officers Wanted as Consultants in Passport Offices