GConnect Income Tax Calculator 2016-17 (Assessment Year 2017-18) with Save Option

GConnect Income Tax Calculator 2016-17 (Assessment Year 2017-18) with Save Option launched – Get to save your income and deductions for effective Tax Planning.

Recently we launched Income Tax Calculator 2016-17 (A.Year 2017-18) which would instantly calculate your income tax payable this year.

Now, to make your job more easier, GConnect Income Tax Calculator 2016-17 (Assessment Year 2017-18) with Save Option has been launched. This online tool will be useful when you do not have all the details for calculating income tax presently and want to save the available data for later use.

Click here for GConnect Instant Income Tax Calculator 2016-17 (A.Year 2017-18)

How to use GConnect Income Tax Calculator 2015-16 with save option?

This online tool has 5 parts. 1. Login Form 2. Entry Form, 3. Work Sheet 4. Income Tax Statement and 5. Save option. Once you have successfully logged in to GConnect Income Tax Calculator with save option, other steps viz., Entry of income and deduction details, generation of Income Tax Work Sheet and generation of Income Tax Statement are similar to GConnect Instant Income Tax Calculator.

One of the most useful features of this tool is relevant provisions in Income Tax Act and Rules relating to each Income, Deduction, Savings, Rebate etc are available in the tool itself. To get these provisions point the mouse on the description against each field in which you are entering data.

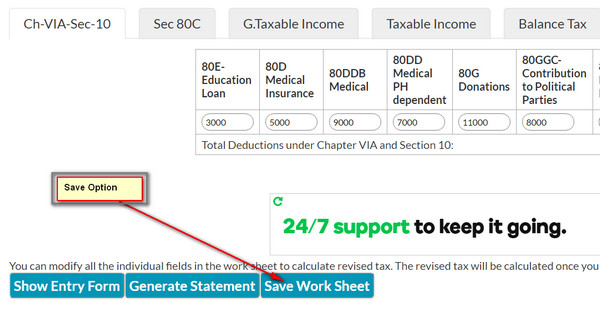

The additional feature provided in this online tool is the save option using which the users can save values after generating work sheet. Even if values for any of the Income, Deductions or savings are not known, enter known values, generate work sheet and then save the work sheet using the “Save Work Sheet” Button. Once values for remaining Income, Deductions or savings are available on a later date, enter the same, and generate work sheet again before saving the work sheet.

If you find that Income Tax work sheet which is generated is correct in all aspects, use generate statement button to for Final Income Tax Statement.

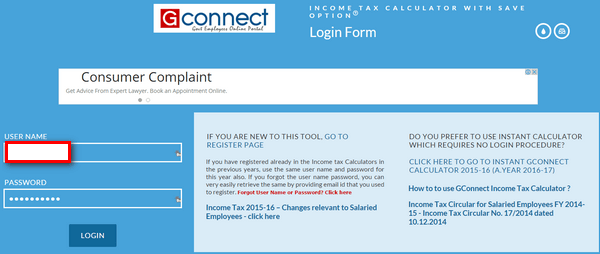

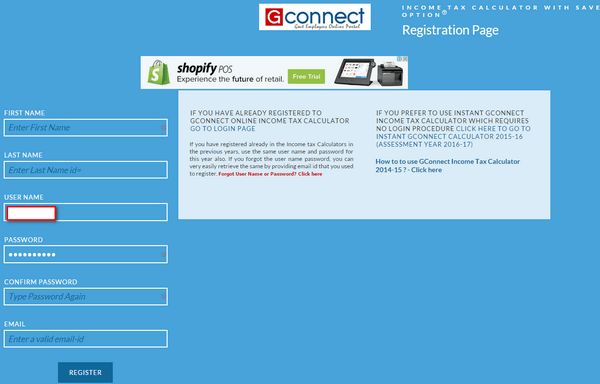

Login Page:

In order to save all values relating to income tax details of each and every user, this requires registration and login procedures.

Login using existing username and password if you have registered for GConnect Income Tax Calculator with save option. If you have forgot your user name or password you easily retrieve the same using “Forgot User Name or Password link” available in the login form. You can also register as new user through GO TO REGISTER PAGE Link which is available in the login page.

Entry Form, Work Sheet and Income Tax Statement

Entry Form, Work Sheet and Income Tax Statement in this tool are same as GConnect Instant Income Tax Calculator 2016-17. To read the how to guide for these parts of the tool Click here

Save Option

After calculating Income Tax by clicking Calculate IT Button, data entered in the tool can be saved by clicking “Save Work Sheet” Button.

Click here for GConnect Instant Income Tax Calculator 2016-17 (A.Year 2017-18)